Auto Financing

By leveraging KredosAi to promote timely payments, auto lenders can improve their financial stability, operational efficiency, and customer satisfaction with fewer vehicle repossessions.

Customer Pain Points

-

The average delinquency rate

for auto lenders is

5% per month. The average delinquency rate

for auto lenders is 5% per month. -

Repossessions cost auto lenders

over $8,000 per vehicle. -

Digital fatigue has increased

over 20% in the last four years.

Auto Financing use case

The situation.

Auto lenders face high loan default and delinquency rates which can severely impact profitability and increase risk exposure. The average delinquency rate is 5% for auto loans that are 30 days or more past-due. Unemployment rates, inflation, and overall economic health impact borrowers' ability to make timely payments.

When an auto lender has to repossess a vehicle because the loan hasn’t been serviced, not only does the lender lose money on the loan, but they also have to pay on average $6,000 or more to repossess the vehicle. Legal costs, storage fees, and repair and reconditioning of the vehicle add up and can harm profitability.

Auto Financing Use Case

Our solution.

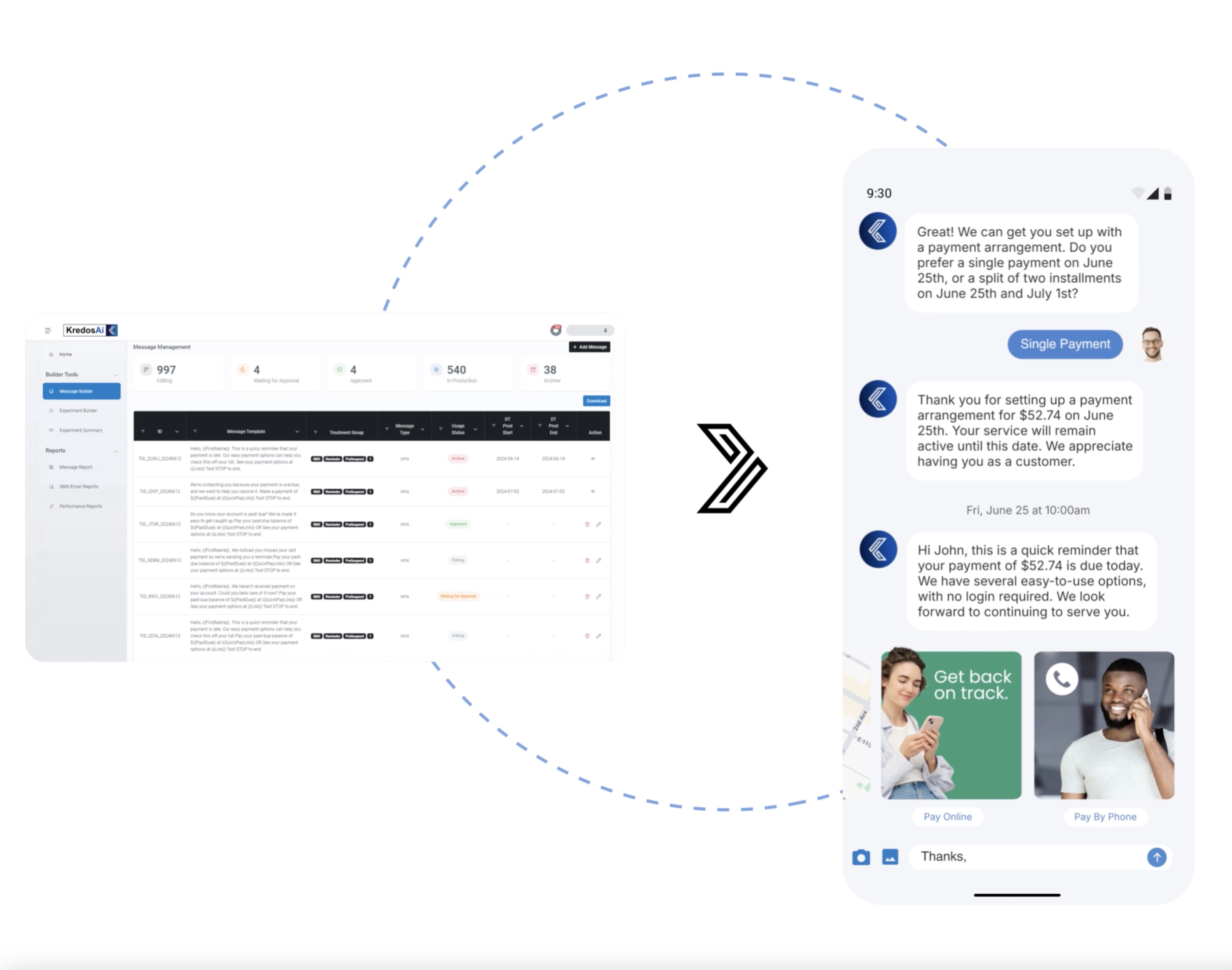

Implementing KredosAi for managing auto loan payments helps financers reduce late payments, improve customer engagement, and enhance overall satisfaction. Personalized reminders and incentives make it easier for borrowers to stay on track, leading to better financial outcomes for both the lender and the borrower.

Data Collection and Analysis

KredosAi gathers and analyzes data from the borrower's payment history, communication preferences, and financial behavior. The platform assesses factors such as payment punctuality, average payment amounts, and any history of late payments.

Personalized Payment Reminders

Based on the analysis, the KredosAi platform generates personalized payment reminders tailored to the borrower’s behavior and preferences. Reminders are sent through the borrower's preferred communication channels, such as SMS, email, or mobile app notifications.

Predictive Insights and Alerts

KredosAi predicts potential payment issues based on patterns in the borrower’s financial behavior. If the platform detects a likelihood of late payment, it sends early warnings and offers solutions such as payment rescheduling options. Rapid reinforcement learning enables the lender to learn what messages work best, and the platform can deploy the winning message at scale.

Incentive Programs

KredosAi identifies opportunities for the auto financer to offer incentives to borrowers who consistently pay on time. Incentives could include cashback offers, interest rate reductions, or entry into sweepstakes for borrowers who maintain a perfect payment record for a certain period. The platform tracks the effectiveness of these incentives and adjusts strategies based on borrower response.

Auto Financing Case

Expected Outcome

Enterprises using KredosAi are seeing a 20x return on investment. Suspend rates are reduced by 8-10%, payment pull forward rates improve by more than 10% in days sales outstanding (DSO), and more subscribers are retained than using outdated approaches or legacy systems.

KredosAi’s AI-powered experimentation approach sends the right message based on behavioral economics, learns in real time from customer behavior, and determines the best outcome strategy for each customer.

This allows you to:

- Test more factors at one time

- Stop outreach strategies that aren’t effective sooner

- Understand why some outreach strategies perform better than others

- Gather statistically significant data to inform better decision making