Financial Services

The traditional way of dealing with past-due accounts has been for telco credit and collections departments to do three to four outreaches to the customer via phone or email, asking that they pay their bill or be disconnected from service. Telcos using KredosAi see a reduction in suspensions, an increase in customer loyalty, and are keeping millions of dollars in revenue.

Customer Pain Points

-

Financial services lenders indicate

that 8% of their customers are

30 days or more late loan payments. Financial services lenders indicate that 8% of their

customers are 30 days or more late loan payments. -

The average credit card

delinquency is 90 days past-due. The average credit card delinquency

is 90 days past-due. -

During economic downturns

the average mortgage

default rate is 10%. During economic downturns the average

mortgage default rate is 10%.

Financial Services use case

The situation.

Financial services lenders indicate that 8% of their customers are 30 days or more late on their credit card or loan payments. With total consumer debt in the US rising, financial institutions are competing with other bills, such as groceries and electricity. Ultimately, high rates of late payments or defaults can negatively impact the bank’s credit rating and increase borrowing costs. By addressing payment issues proactively, banks can better manage their overall risk exposure.

Financial Services Use Case

Our solution.

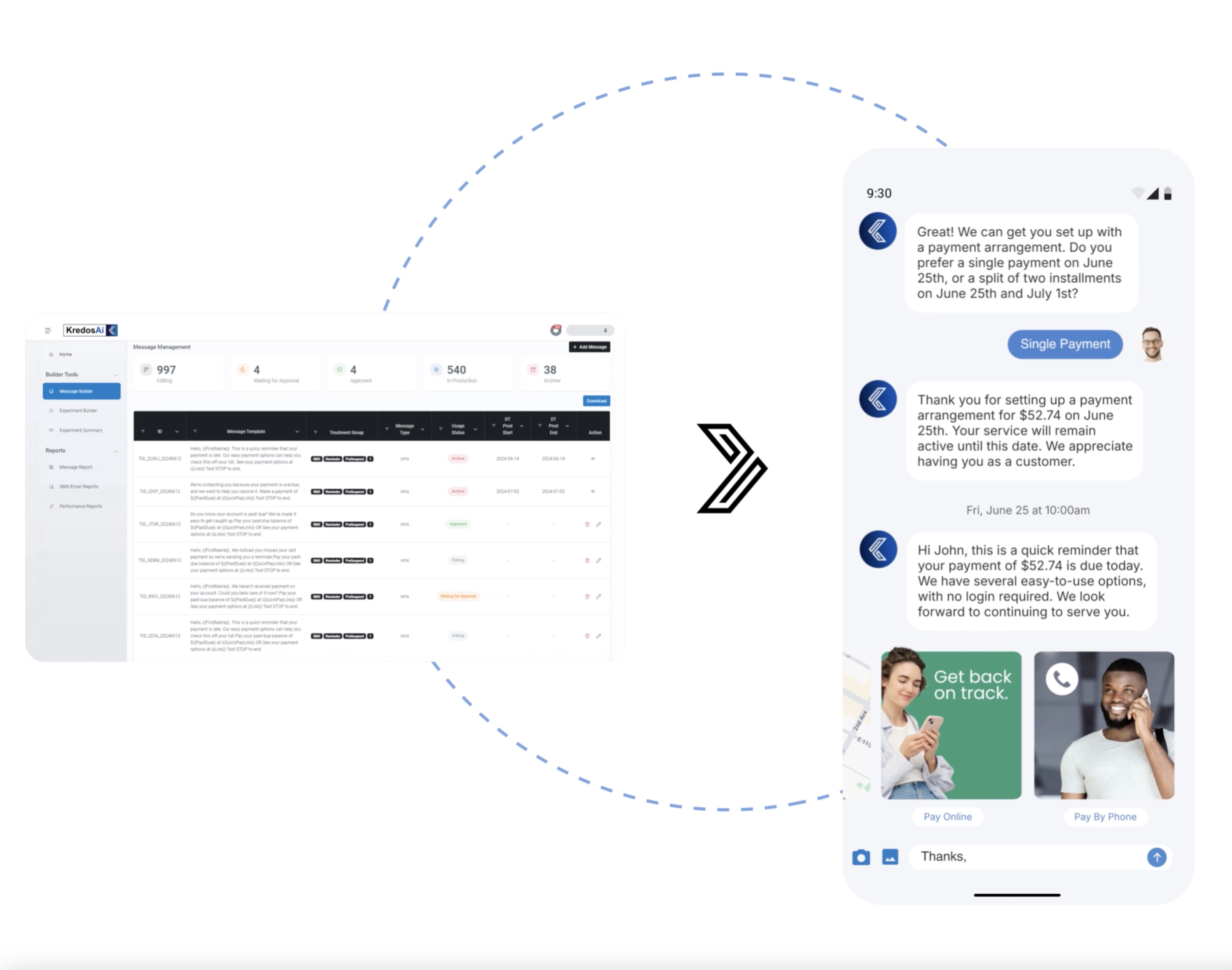

Helping customers stay on track with their payments can improve overall customer satisfaction and loyalty. Financial services that offer support and flexible solutions using KredosAi provide consumers a personalized, efficient, and customer-centric approach to managing late payments.

Predictive Analytics

By analyzing vast amounts of data from customer payment histories, financial behavior, and external factors, KredosAi can identify accounts that are at a higher risk of becoming delinquent, helping financial institutions address potential issues before they escalate.

Personalized Communication Strategies

By adapting communication to the preferences and behaviors of each customer, KredosAi increases the likelihood of prompt payments while maintaining a positive customer experience.

Enhanced Risk Management

The platform continuously assesses the risk associated with each account, providing real-time updates and alerts. This enables financial services to prioritize their past-due efforts effectively, focusing resources on accounts with the highest likelihood of recovery.

Financial Services Use Case

Expected Outcome

Enterprises using KredosAi are seeing a 20x return on investment. Suspend rates are reduced by 8-10%, payment pull forward rates improve by more than 10% in days sales outstanding (DSO), and more subscribers are retained than using outdated approaches or legacy systems.

KredosAi’s AI-powered experimentation approach sends the right message based on behavioral economics, learns in real time from customer behavior, and determines the best outcome strategy for each customer.

This allows you to:

- Test more factors at one time

- Stop outreach strategies that aren’t effective sooner

- Understand why some outreach strategies perform better than others

- Gather statistically significant data to inform better decision making